Introduction

The fundamental tenets of renewables policy are to reduce greenhouse gas emissions, increase security of energy supply, and favour the emergence of least cost solutions. Does our heat policy help or hinder the achievement of these aims? Given the rush to electrify residential heat, using high cost and embodied carbon technologies, and the lack of focus on commercial and industrial heating the answer seems to be more hindrance than help.

Heat accounts for about 38% of all energy use in Ireland (41 TWh in 2018), and 20% of greenhouse gas emissions (almost 14 million tonnes of carbon dioxide). This fundamental, and maybe awkward, fact is drowned out in the discourse about the need to reduce emissions from electricity generation, transport and agriculture.

Last year an evidence-based report from Renewable Energy Ireland – 40 By 30 made a series of policy recommendations across all renewable energy options, from heat pumps to district heating to bioenergy. It was largely ignored, by policy makers and media alike. This is in the context of renewable heat accounting for just 6.7% of heat energy in the 2017. The following year, renewable heat use actually dropped back to 6.5%.

Clearly, we have a long way to go, especially as residential heat use accounts for 42% of all heat use, and it is always difficult to change individual behaviours. Not that commercial or industrial heating, the next highest heat users, are shining examples. Here the story is that one fossil – oil – is being gradually being replaced by another – “natural” gas – largely because of a highly questionable policy of extending the gas grid, linked to extremely low prices. Some of the short-sightedness of that approach is being exposed by gas price hikes, which actually began rising through 2021. More about that anon.

Solid biomass (78%), dominates renewable heat, in particular in the wood processing sector, which has ready access to relatively low-cost residues. One would think that playing to one’s biomass strengths would help to inform a robust heat policy to deploy it and a range of proven technologies and approaches to tackle the fossil stranglehold in the residential and commercial/industrial heat sectors. No, instead an unwavering adherence to an energy efficiency approach – building fabric first – has become the orthodoxy. Commercial and industrial heating rarely get mentioned.

It was refreshing therefore that the national heat study from the SEAI – Net Zero by 2050 published in the past couple of weeks states in one of its Key Insights: Evolving existing policy supports to focus on replacing fossil fuels in buildings can have a more significant and immediate emissions reduction impact than a fabric-first approach. It goes on to state: this approach [fabric-first] is not guaranteed to be consistent with the rapid decarbonisation needed to meet the goals of the Climate Action Legislation. It is also not financially viable for a large proportion of consumers in the analysis. Support scheme design that focuses on meeting the minimum levels of fabric performance to support a switch away from fossil fuel heating sources is likely to see more uptake and require less investment. However, the conclusion that heat pumps are an ideal fit for retrofit-light is open to question, given the level of insulation needed for a high COP and economic operation, and the relatively high capital costs for heat pumps mentioned elsewhere. In many of these situations, modern efficient biomass boilers offer a more economic and higher carbon dioxide saving.

Whatever about policy-based incentives to change behaviours, unforeseen events have a habit of challenging the best laid plans. Nothing more so than those leading to scarcity and price hikes. One of the consequences of the lessening of the Covid-19 pandemic has been resurgent demand for fossil fuels, which has led to price increases. These have been made more acute by the war in Ukraine. These increases in demand and tightening in supply has inevitably led to steady and then sharp increases in prices of transport and heating oil, and in gas, albeit the latter has yet to fully impact.

While oil and gas prices have a volatile history, and can and will fall back from current peaks, a number of commentators forecast that any new equilibrium is unlikely to see prices return to the low levels of recent years[1]. This is likely to put pressure on not only deep retrofitting investment, but also on carbon tax and the projected increases to 2030. Whatever about the efficacy of retrofitting policies, it is well to remember that carbon taxes have underpinned best in class renewables performance by countries such as Denmark and Sweden.

Recent events –and the soaring cost of home heating oil

So, recent events have once again turned the focus on the cost and availability of fossil fuels, particularly transport and home heating oils. Prices for heating oil have reached the levels not seen for a decade, and have recently peaked over 1.60/litre, an effective doubling since the beginning of the year[2]. Those who heat their homes and buildings using woodfuel can count themselves lucky to be largely insulated from the price spikes of the past weeks.

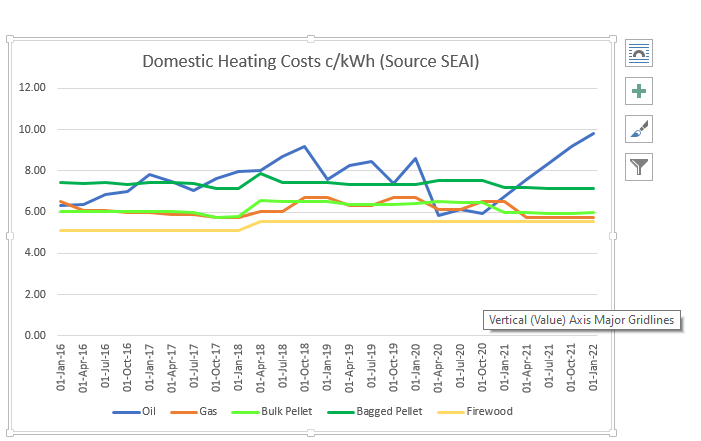

As Figure 1[3] shows, home heating oil had

been climbing in price since the latter part of 2021, on foot of supply chain

constraints and increased demand. Woodfuel prices have remained relatively

stable over the period since 2006. But it is fair to say as input costs rise, woodfuel

is also likely to increase in price, though at nowhere near the level seen for

oil.

Figure 1. Fuel prices in Ireland, 2016 to January 2021.

If oil settles back to the €1000/litre level, woodfuels at current prices still remain very competitive as Table 1 shows. A price of €800/litre makes oil more competitive with wood pellets.

| Fuel | Unit | Price € | c/kWh | Annual cost € |

| Oil | 1000 litres | 1000 | 9.40 | 1316.00 |

| Wood pellets (bagged per tonne) | 1 tonne | 380 | 7.82 | 1094.80 |

| Firewood (20% MC – bulk delivery) | 1 tonne | 248 | 6.00 | 840.00 |

Commercial and industrial heating

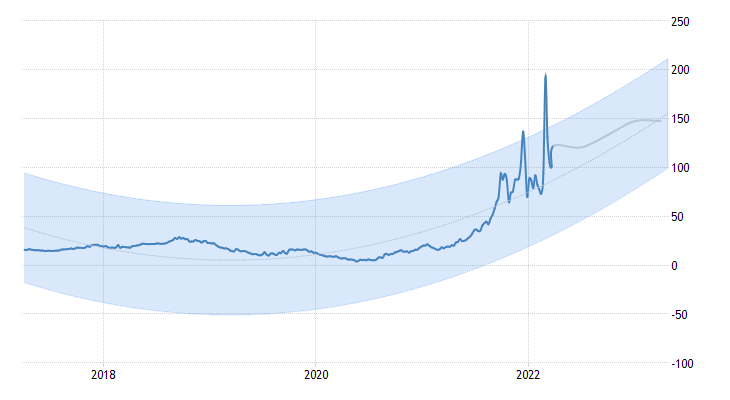

At a commercial and industrial

scale, gas and oil are the dominant energy sources for space and process

heating in Ireland. Open market gas prices for large consumers were running at around

2-3 c/kWh through 2020 and early 2021, a price that biomass suppliers found

hard to match. Through the second quarter of 2021 and to year end, prices rose

to over 5 c/kWh. The war in Ukraine has caused prices to spike at 20 c/kWh in

recent weeks (Figure 2), and while the price has inevitably fallen back, some commentators[1] forecast a hardening of

prices up to 25-27 c/kWh through to the middle of 2023. Though it hard to see

such a price being sustained for any given period, likewise it is difficult to

see a future gas not being well above a multiple of the 2020/early 2021 price,

at least into 2023.

Figure 2. Historic and predicted natural gas prices denominated in euro/MWh[1], and based Dutch TTF Gas benchmark price.

These events may encourage more commercial and industrial users to consider investments in renewable energy and biomass in particular. But significant barriers to change remain, not least the capital cost of changing away from oil and gas heating, and there is good case for state polices to financially support fuel switching. The current instrument in that space, the SSRH (Support Scheme for Renewable Heat) however lacks any significant level of ambition, and has become bogged down in red tape since its initiation over two years ago. Its rule set needs to be made far more explicit, so as to remove uncertainty for investors, it needs be strongly promoted and the funding models extended to large scale industrial heat users.

While residential gas users saw average prices fall by 12% in the first half of 2021, they have increased since and now stand at 7-8 c/kWh. This price, as indicated, is likely to rise as forward bought stocks are depleted.

Electricity prices

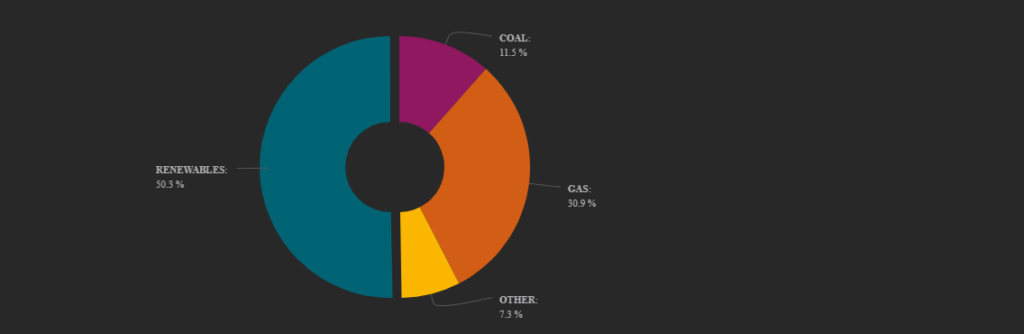

Similar considerations apply to

electricity prices, given the need to stabilise the grid against variable

sources such as wind. Over the month to the 12 March, about half of electricity

generation was from wind and other renewables (including dispatchable biomass

power and CHP), and half from fossil, mainly gas (Figure 3).

Figure 3. Average “fuel mix” on the Irish grid 12 February to 12 March 2022 (The “Renewables” category includes wind, solar and hydro sources. The “Other” category includes Peat, Distillate, Waste, Combined Heat and Power (CHP), Aggregated Generating Units (AGUs), Demand Side Units (DSUs) and Turlough Hill in generation mode.) Source https://www.smartgriddashboard.com/

A consequence of the continuing deployment of wind on the grid, and the switch from coal and oil to gas, is the gradual lowering of embodied carbon dioxide emissions in electricity supply. By 2018 this figure had reached about 300 g CO2/kWh. But it remains a fact that heat pumps, even allowing for COP[1] of 3, still carry embodied emissions of about 100 g CO2/kWh. Woodfuels also have embodied carbon emissions, due mainly to fossil fuel use in harvesting, transport and processing. These range from 15 to 30 g CO2/kWh and are well below the greenhouse gas savings requirements set out in the Renewable Energy Directive II that woodfuels and all bioenergy must meet to be rated as zero caron dioxide emissions.

So, for the present the greenhouse gas savings on fossil fuel displacement are considerably higher for woodfuel systems, and they are a lot cheaper to install than heat pumps. For an average Irish home, an air source heat pump can cost from €12,000-€18,000, depending on installation cost. Plus, there is the need to operate in houses and buildings with a high level of insulation, otherwise the heat pump will struggle to provide water at 40 oC, the COP will fall, and costs and greenhouse gas emissions will rise accordingly. A good quality, Ecodesign compliant woodfuel pellet stove boiler costs around €5,000-€6,000 including installation.

These comparisons also need to take fuel and maintenance costs into consideration, as well the lifetime of installed plant. Allowing for current fuel prices and maintenance levels, pellet stoves and boilers still remain competitive against all other sources, and that is without fully including the level of carbon tax which is set to increase from the current €33.50/tonne of CO2 to €100/tonne by 2030.

At the larger scale it is worth remembering that policies to install 600,000 heat pumps and have over 900,000 electric vehicles on the road by 2030 would add about 1.4 GW to electricity demand. Even if there is sufficient installed wind and solar capacity on the grid to meet demand, there are days when renewables fall below 10% of demand, so back-up capacity and grid imports are needed to power and stabilise the grid. Gas is seen as the answer to the capacity problem, in the period up to 2030. The Climate Action Plan foresees a need for an additional 2 GW of gas-fired generation over the period up to 2030. The recent EirGrid/SONI auction resulted in the award of 1.5 GW new capacity, almost all to come from planned new gas-fired carbon emitting plants. Whether this will be sufficient for anticipated growth in electricity demand, and at what cost is unclear, as there is a lack of independent analysis of Ireland’s electricity capacity. In light of recent gas prices jumps and reduced supply such analysis becomes even more necessary.

What can bioenergy and woodfuel in particular contribute to renewable heating

Another Key Insight from SEAI heat study is Available domestic solid and gaseous biomass fuels are used in all scenarios. Nationally appropriate sustainability governance is required to minimise upstream emissions, align with circular and bioeconomy goals, and avoid increasing emissions in nonenergy sectors. Between 7%-17% of heat demand is supplied by bioenergy by 2030 and a similar proportion in 2050 (underlining added).

The wide range in the estimates is based on the feasibility of different scenarios which bring biomethane and short rotation coppice on stream, based on policy development and underlying costs, and the necessity in the model to secure overall net zero greenhouse gas emissions by 2050. The scenarios are outlined in the Sustainable Bioenergy for Heat study which accompanies the SEAI heat study.

The current annual heat demand across all sectors is outlined in the heat study as about 60 TWh or 216 PJ per annum. The upper 17% would therefore target would entail about 37 PJ bioenergy per annum by 2050 across all scenarios. As I am familiar with the forest sector numbers, I will concentrate on them.

Let us start with the current level of use of woodfuel for heat, which was about 7.3 PJ in 2018 and set that as the baseline. All scenarios in the report assume an underlying supply potential 14-15 PJ per annum from woodfuel. This assumption is based on the COFORD roundwood production forecast figures for the period 2020-2040. I have adjusted these estimates based on

- and assuming a 50% higher intensity of sustainable biomass recovery from thinning for energy purposes, and

- bringing an additional 3,000 ha of clearfell per year into residue collection.

Table 2 shows the results of the adjustments by netting off existing use, and the expected intake of indigenous forest biomass at Edenderry power, assuming a move to 100% biomass. The plant is brought out of generation in 2030 and this frees up an additional 7 PJ or so per annum for use in more efficient heat projects.

No assumption has been made with regard to supply of additional material from newly established short rotation coppice, which the report indicates could provide an additional 3 PJ per annum from 2030 onwards. This level of supply is contingent on high price paying potential for bioenergy. The forest woodfuel resource on the other hand is forecast for existing plantations.

As regards demand an implicit assumption is the presence of strong set of measures across the residential sector and commercial and industrial sectors, and that gas and oil prices do not fall back to 2021 levels for extended periods.

Table 2. An estimate of additional woodfuel availability from indigenous forest sources for the period 2020-2040.

| Year | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

| Net additional availability PJ (000 cubic metres) | 2 (260) | 5 (640) | 14 (1,890) | 16 (2,140) | 14 (1,950) | 12 (1,630) |

Conclusions

What could this potential additional woodfuel resource be directed towards in the context of the primary aim of renewables policy – reducing greenhouse gas emissions?

- A straightforward and simple aim would be to immediately start to make inroads into the one million or so homes that use oil as the main heating fuel by switching to woodfuel, say 10,000 homes per year from 2023 to 2020. The woodfuels could be either low moisture firewood or pellet, the latter to come from a greatly expanded level of indigenous pellet production. The fuels should be combusted in modern high efficiency, low emission Ecodesign stove/boilers. The aim would be to target homes which are difficult to retrofit due to age or other factors, with an aim to meet the minimum levels of fabric performance to support an efficient switch away from fossil fuel heating. This measure would entail the use of 4 PJ of woodfuel, or 450-500,000 cubic metres derived from sawmill residues (pellets) and early thinnings and residual roundwood harvest. This would deliver a saving of 290,000 tonnes of carbon dioxide per annum by 2030, in a sector that is otherwise difficult to decarbonise.

- The SEAI national heat study identifies district heating as a technology that could provide as much as 50% of building heating demand in Ireland. It is a proven and available technology. Wood fuelled district heating is a tried and trusted across many European countries, including Denmark which has a similar forest resource distribution and size to Ireland, as well as a similar winter heating profile. A number of large towns in Ireland have significant institutional and commercial users of heat, some oil fuelled, but also gas. In order to begin this process a pilot scheme for five town district heating plants, scaled at an installed capacity of 8 MWh should be initiated. This would entail a woodfuel supply of 1 PJ or 80-100,000 cubic metres per annum towards the end of the decade, with an annual saving of 70,000 t of carbon dioxide.

- Robust and sustained markets are key to mobilising woodfuels, developing supply chains at scale and making the most of a scarce resource. Given the supply dynamics from the forest sector it is clear that additional sources of woodfuels and other energy vectors would be needed for bioenergy to provide up to 17% of heating. To reach that level it is essential that market development should come first, which should then provide a price for short rotation coppice and short rotation forestry to aim at reaching. Experience in the past with energy crops has shown the need to have a sustainable market price to make them viable. Very similar considerations apply to the forest resource. As alluded to earlier, the SSRH scheme needs to be streamlined and expanded, and particularly in order to make enable bioenergy-based district heating. Regarding the residential side a grant scheme for Ecodesign boilers, allied to a level of fabric improvement should be considered. If grants for heat pumps why not for modern bioenergy?

- New technologies such as bioenergy with carbon capture and storage (BECCS), and the use of biochar are emerging to meet the climate challenge. BECCS offers the prospect of so-called negative emissions, which the Intergovernmental Panel on Climate Change says will be necessary to meet net zero by 2050. It is now an available and off-the-shelf technology, but securing geologic storage sites needs further analysis and investigation. Policies and measures in this area will be guided by Commission’s proposals for the certification of carbon removals due this year (see article in previous edition). Given a workable policy framework, and an accessible storage capacity, BECCS could become a viable economic proposition and a commonplace part of existing and new bioenergy facilities.

[1] COP is he relationship between the power (kW) that is drawn out a heat pump as cooling or heat, and the power (kW) that is supplied to the compressor.

[1] Divide by 1000 to get price in cent/kWh

[1] https://tradingeconomics.com/

[1] See for example Embrace high fossil fuel prices because they are here to stay by Amrita Sen at https://www.ft.com/content/a15e7ade-dad0-4ed3-a172-1974ac9d5b23

[2] oilprices.ie

[3] To compare prices, one litre of home heating is equivalent to 10.35 kWh, one kg of pellets is equivalent to 4.9 kWh. Actual heat provided will depend on boiler efficiency.

Leave a Reply